By: J. Lennox Scott | Chairman and CEO

What you see is what you get!

1 Normal seasonal cycle – just fewer transactions

2 Seasonal ebbs and flow within the yearly housing cycle

Get In Touch

Rock Out with Your Guac Out — A Better Avocado Experience Starts with RAD

The days of under and over-ripe avocados are over. Find the perfect avocado for your culinary needs when you need it most — RAD takes the guesswork out of the formula and helps you find the raddest avocados every time.

HOUSING

FORECAST

By: J. Lennox Scott | Chairman and CEO

3 Restriction of supply will continue throughout 2024+

4 Sellers will move for the same reasons in 2024

CONVERGENCE

Higher home mortgage interest rates are creating a convergence between two scenarios that are restricting

supply of resale properties coming on to the market in the normal sequence, especially in the more affordable

and mid-price ranges.

Higher home mortgage interest rate

Fewer buyers

(70% have a home to sell)

Result: Fewer Homes for Sale

Homeowners locked into sub 4% mortgage

Some are delaying their move

Fewer Sellers

Result: Fewer Homes for Sale

In many areas with fewer homes available for sale and strong buyer activity in the more affordable and mid-price

ranges, there is price support. Additionally, we anticipate price increases where there is a shortage of homes for sale.

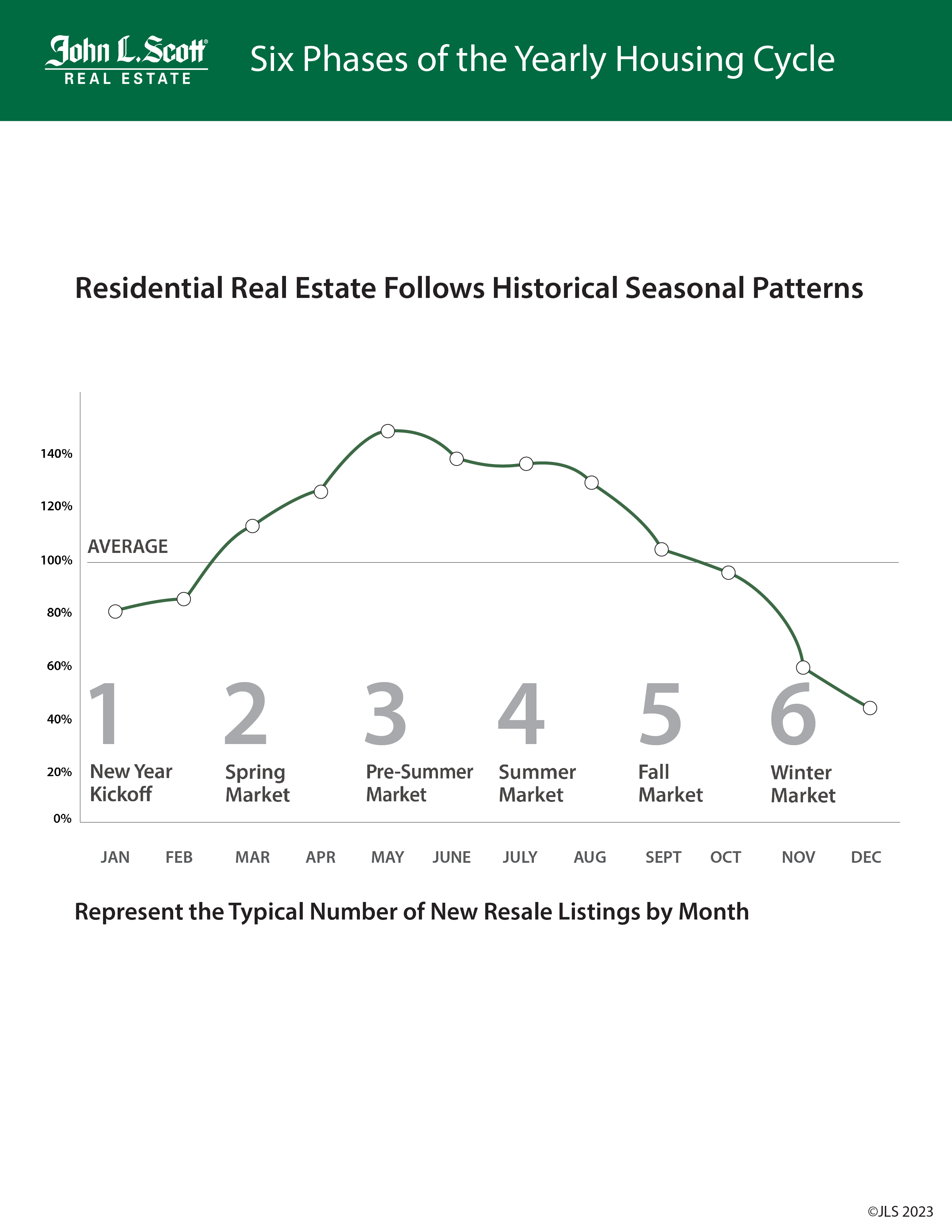

6 Phases of the Yearly Housing Cycle™

Represents Number of New Resale Listings by Month

Typical yearly pattern of new resale listings

WHO IS MOVING IN TODAY'S MARKET

Job Transition

Household formation change (Marriage, Divorce, Downsizing, Estate)

Retirees and Seniors (substantial equity)

4+ years in home (major equity)

One third of homeowners have no mortgage debt

Purchase when the timing is right for you.

In your local market, if there is a shortage of supply of available homes for sale, we often see an increase in

home prices after the first of the year, especially in the more affordable and mid-price ranges.

The math may lean toward purchasing today.

Economists are forecasting that home mortgage interest rates will lower over the year ahead.

However, weigh today’s higher monthly home mortgage interest payments against the possible increase in home prices.

Should I purchase today or wait until interest rates come back down?

Again, it’s in the math.

How long are you going to stay in your home?

Roll refinance fee into new mortgage

Payback calculation period is usually less than one year

When is the time to refinance?

Sales Activity Intensity™ Indicator

In a typical year, the Sales Activity Intensity™ of new resale listings going under contract increases one to

two levels in the spring and then mellows back down in intensity over the summer and fall.

Where will home mortgage interest rates be in 2024, and how will that

affect the residential market?

ABOVE 7%

UPPER 6%'s

LOWER 6%'s

Current

Market Conditions

More buyers, a few more listings higher intensity

Many more buyers, a few more listings higher intensity possible

price increase

Several economists are forecasting that 2024 home mortgage interest rates will decrease into the 6%’s

and go even lower in 2025. They either will, or they won’t.

KITsap COUNTY

SEPARATE MARKETS

Job growth is the #1 major indicator to a strong housing market

Major Metro Market Areas

If there is strong sales activity in major metro market areas, there tends to be more homebuyers that relocate to surrounding/lifestyle/destination markets.

Additionally, those buyers with major home equity are repositioning to these markets for several main reasons:

Closer to family and friends

Lifestyle and environment

Downsizing, second home, investment

LIFESTYLE/DESTINATION MARKETS

Luxury Market

Currently, great selection and great pricing

Starting in the fall, winter clean-up of luxury inventory begins (Several homes will be taken off market and repositioned for spring)

When home mortgage interest rates lower and the wealth effect increases, we will see increased luxury sales activity

Then, musical chairs will happen for selected properties

Chat with your John L. Scott Broker Associate for the following:

For Buyers

Be Buyer Ready, Day One™

If possible, become fully underwritten for a mortgage before purchase agreement.

For Sellers

Be Market Ready, Day One™

Showcase your home in the best light to get the best price.

Seller Listing Launch - Marketing Your Property

Focuses on the backlog of buyers while we meet new buyers entering the marketplace.

Highest Sales Activity Intensity™ is the first 30 days on the market.

®

LIFE EVENTS

THOSE WITH MAJOR HOME EQUITY